A Look Into The Markets - July 18, 2025

Good Inflation News

Higher than desired inflation has been an ongoing story since prices started rising higher over 4 years ago. The good news? Inflation continues to ease or deflate and is currently running at four-year lows. This past week an important reading on consumer inflation was released.

The consumer price index (CPI) for the month of June revealed that the more closely watched Core CPI, which removes food and energy, was reported below expectations and at 2.9% year over year. When you compare June prices to January, the annualized change for Core CPI is 2.1%. This is well within the Fed's comfort zone, highlights that prices are headed lower, and it appears time for the Fed to cut interest rates.

Adding to the good news on inflation; Producer Prices (PPI), or inflation at the wholesale level, also came in very tame with a 0.0% reading month over month. This is welcome news as PPI is a leading indicator of consumer inflation. If producers or wholesalers are experiencing price pressures, they may have to pass the added costs to the consumer. The opposite is true. Seeing no producer inflation in the face of the tariff uncertainty is also welcome news; let's hope this trend continues.

Debt Across the Globe

Government spending around the globe is huge and requires countries to sell bonds to fund these budget deficits. Countries like Japan, Germany, the UK, and the United States are seeing pressure on long-term bond yields as a sign to get their debt and deficits in order.

In Japan, their 30-yr Bond yield ticked above 3.07% and is currently at the highest levels since 2000. As yields tick higher around the globe, it puts upward pressure on our yields. This is one reason why our yields have pushed higher in recent weeks.

Fed Chair Powell to Stay or Go

Over the past couple of months, there has been a lot of talk and chatter about Jerome Powell stepping down as Fed chair or being outright fired. Outside of all that noise and uncertainty, the bond market had a few words to say about this potential development. This past week, rumors emerged that Powell would indeed be fired. On the breaking news, the 10-year note, and 30-year bond yields spiked higher. Why? There's speculation that if a new Fed chair was installed, they would cut rates too much too quickly and potentially reignite inflation…which long-term bonds do not like.Within hours of the rumors emerging, President Trump put out a statement saying he had no plans to fire Jerome Powell. As a result, stock prices moved higher, and interest rates improved from their worst levels.

| 30-yr Mortgage Rates | 17-Jul-25 | |

| 6.75% | ||

| +.03 WoW (6.72%) | -.02 YoY (6.77%) | |

| 10-year Note Yield | 18-Jul-25 | |

| Below 4.50% | ||

| This time 2024: Below 4.50% | ||

Looking Ahead

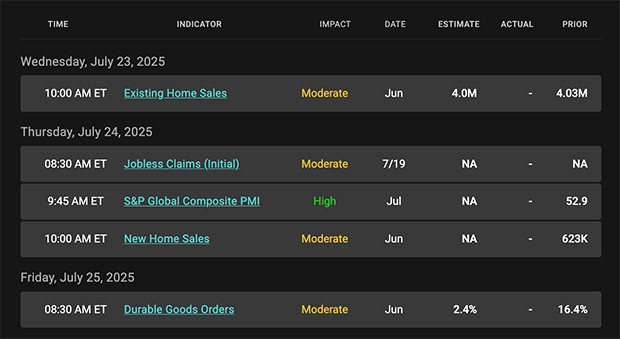

Next week, the economic calendar is light, with no high-impact economic reports scheduled for release. And there is only the 20-year Bond auction to hurdle. Moreover, as we march towards the next Fed Meeting on July 30th, we enter the Fed blackout or “quiet period”. The Fed's blackout policy is clear: there are no public comments related to monetary policy from July 19 through July 30 for the July FOMC meeting.

|

|

Categories

Recent Posts

concierge@pennergroupproperties.com

16037 SW Upper Boones Ferry Rd Suite 150, Tigard, OR, 97224