A Look into the Markets - October 4, 2024

"Good times bad times I know I've had my share" – Good Times Bad Times by Led Zeppelin.

The Bad Times

The big news of the week was the increased conflict and tension throughout the Middle East between Israel, and Lebanon. Typically, elevated geopolitical tensions would be good for bonds and ratIran, es as the increased uncertainty creates a safe trade into the US bond market.However, increased tensions in the Middle East also push oil prices higher, which they did, and higher oil prices are inflationary and bad for long-term bonds like mortgages.

More Bad Times

The Federal Reserve has made it very clear that they are shifting their attention more towards the labor market portion of their dual mandate as inflation has continued to move lower. This past week, we received some promising labor market numbers, which showed more jobs available than expected and more private payroll creations than expected. This good news was bad news for bonds, as it takes the likelihood of a 0.50% rate cut off the table anytime soon.

The good news also breathes life into the idea that the economy can endure a soft landing where inflation moves towards the Fed's target of 2.00% while we avoid an economic recession. This story will change, but for now, the good news is putting a limit on how much better rates can improve in the near term.

Fed Chair Powell Speak

Early last week Federal Reserve Chairman Jerome Powell spoke and said he expects to cut rates methodically, leading the markets to believe that further .50% rate cuts will not be in the cards in the months ahead. Based on this week's economic data, we should probably take those words at face value for now.

3.80%

The 10-yr Note has been touching but not closing above 3.80% for over the past week. A meaningful close above this level would be bad for rates near-term as 3.80% will go from being as bad as rates could get to being as good as rates could get.

Bottom line: Good news is bad news for bonds and the opposite is true. Any further improvement in interest rates will likely require some softer economic data as interest rates improved significantly in anticipation of the first rate cut.

Looking Ahead

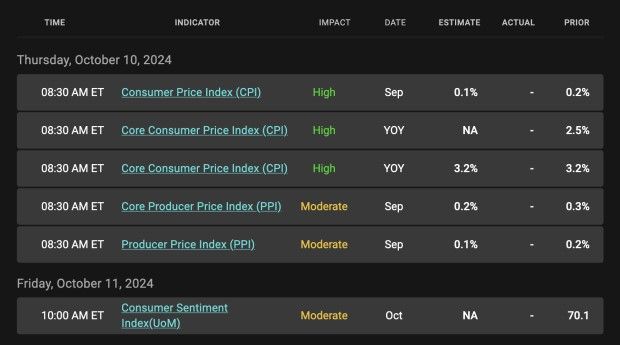

Next week brings the important Consumer Price Index (CPI) and an important reading on inflation. If this reading shows further moderation, it will be good for long-term rates. It will also be good for the Fed as they can continue to focus their attention on the labor market. Of course, if the inflation reading comes in hotter than expected, it will complicate things for the Fed. In addition to the inflation numbers, our Treasury will sell billions of dollars in new debt, which will need to be absorbed by the markets. If the buying appetite is not strong, rates can move higher. The Fed minutes from the September meeting will be delivered on Wednesday and will be closely watched by the markets.Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices and rates improved in anticipation of the Fed rate cut but have since worsened.

|

|

Categories

Recent Posts

concierge@pennergroupproperties.com

16037 SW Upper Boones Ferry Rd Suite 150, Tigard, OR, 97224