A Look into the Markets - October 25, 2024

“Broke all the rules Played all the fools Yeah, yeah, they, they, they blew our minds!” – Thunderstruck by AC/DC

On Sept 16th, the 10-year Note yield bottomed at 3.61% and has continued to trend higher causing mortgage rates to also move sharply higher in a short amount of time. How fast have rates moved? We have witnessed the quickest spike in rates after an initial Fed rate cut since 1995, when the Federal Reserve Chair Alan Greenspan orchestrated a "soft landing" whereby they were able to lower rates and avoid a recession.

This is essentially what the financial markets are also thinking today. With unemployment at just 4.1% and recent reports suggesting continued economic strength, the bond markets are adjusting rates to the idea that the economy will avoid a recession...for now.

Fears of Inflation Exist

Bonds and home loan rates loathe inflation. Next week will be big when the Fed's favored gauge of inflation, the Core Personal Consumption Expenditure Index (PCE) is reported. For now, markets have tuned to the Consumer Price Index which has climbed from an annual run rate of 2.00% in the 2nd Quarter to 3.00% in the 3rd Quarter.

Currently, the Fed is essentially claiming victory that inflation is moving sustainably towards 2.00%. However, the bond market is now questioning this notion, which has added a huge amount of uncertainty and volatility.

Fed Rate Cuts Still Coming

Despite the fears of a stronger than expected economy and inflation possibly reaccelerating or at least sticky, the markets continue to price .25% rate cuts at each of the next two Fed Meetings. This can change after next week when a lot of important news is delivered.

Even Fed officials have been mostly acknowledging that a gradual pace of rates remains appropriate...we shall see.

Debt is a Headwind

If we were looking for one more headwind for rates, look no further than our increased debt. Just in the last four weeks, our government debt increased by more than $455 billion. There is a saying in the bond market: bonds hate more bonds, meaning the Treasury Department must sell more bonds to fund our underfunded government, and this additional supply adds weight to prices, which slows rates from improving.

4.20%

The 10-year yield has quickly risen to 4.20%, a level that has previously prevented rates from climbing higher. If this ceiling is broken once again, we will likely see yields spike to another level quickly, much like they did when it pierced through 4.00% and 4.10%.

Bottom line: Home loan rates continue to climb despite a relatively slow news week. This can all change next week as several high impact reports are released.

Looking Ahead

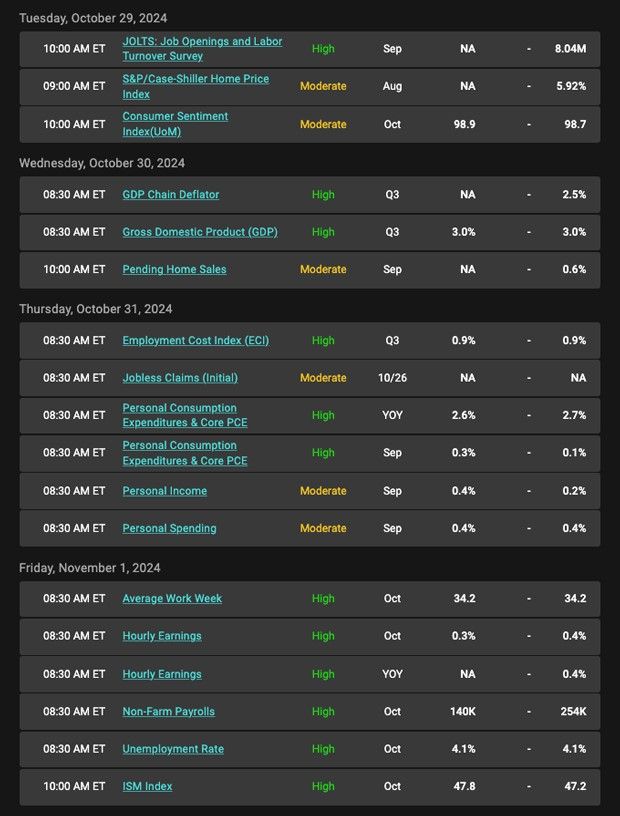

Next week may very well be more important than the following week when Election Day and The Fed Meeting take place. We are going to get the Core Personal Consumption Expenditure (PCE) Index which will tell us how inflation looks. And if that were not enough, we will see several labor market readings including the Jobs Report.Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see the trend of lower prices and higher rates remains intact.

Chart: Fannie Mae 30-Year 5.0% Coupon (Friday, October 25, 2024)

Economic Calendar for the Week of October 28–November 1

|

|

Categories

Recent Posts

concierge@pennergroupproperties.com

16037 SW Upper Boones Ferry Rd Suite 150, Tigard, OR, 97224