A Look Into The Markets - Sept 5, 2025

This week, the labor market and falling interest rates were in focus, with 30-year mortgage rates hitting their lowest since October 2024. Here's what happened and what's ahead for us.

"Ain't no mountain high enough,Ain't no valley low enough,

Ain't no river wide enough,

To keep me from gettin' to you, baby" -

Ain't no Mountain High Enough by Marvin Gaye and Harvey Fuqua

"We do not seek or welcome further cooling in labor market conditions."

- Fed Chair Jerome Powell, Aug 23 2025

Note: Fed rate cuts don't always lower long-term mortgage rates. For example, last September's 0.50% cut led to a 0.60% spike in the 10-year Treasury note and mortgage rates.

JOLTS: Fewer Job Openings

The Job Openings and Labor Turnover Survey (JOLTS) reported 7.2 million job openings, slightly below the prior reading and the lowest in nearly a year. However, hiring and quit rates remained stable, offering some positive news.

Services Sector Keeps Growing

The services sector, including real estate, expanded for the third consecutive month, per the ISM Services PMI Report. The PMI hit 52% in August (up from 50.1% in July), marking expansion for the 13th time in 14 months.

Key Points:

Business Activity: Strong at 55% (up from 52.6%), steady since May 2020.New Orders: Jumped to 56% (from 50.3%), signaling rising demand.

Employment: Weak at 46.5% (slightly up from 46.4%), showing hiring challenges.

Supplier Deliveries: Slowed to 50.3% (from 51%), reflecting higher demand.

Prices: High at 69.2% (down from 69.9%), indicating persistent cost pressures.

What this means for you: The services sector, including real estate, is experiencing consistent growth driven by strong business activity and new orders. However, rising prices and slower deliveries may impact costs, while hiring challenges persist.

| 30-yr Mortgage Rates | 4-Sep-25 | |

| 6.50% | ||

| -.06% WoW (6.56%) | +.15 YoY (6.35%) | |

| 10-year Note Yield | 5-Sep-25 | |

| Below 4.50% | ||

| This time 2024: Below 4.50% | ||

Bottom Line: Mortgage rates are at 10+ month lows, and the 10-year note yield looks poised to break out of its long-standing range between 4.20 and 4.50%.

Looking Ahead

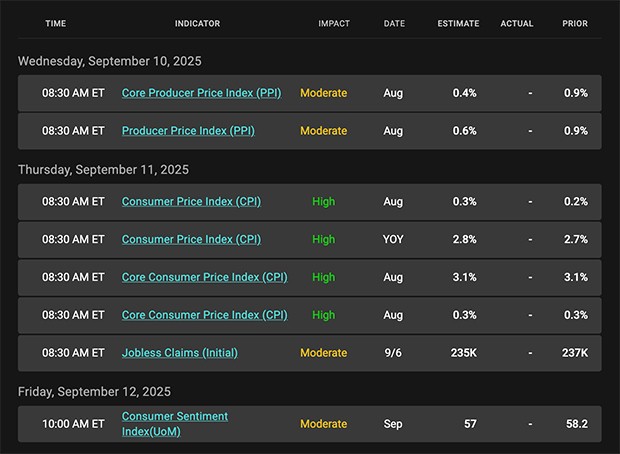

Next week, the Fed enters its pre-meeting blackout period, so no public comments are expected before September 17th.

Key events include:

- New Treasury debt sales (10-year notes and 30-year bonds)

|

|

Categories

Recent Posts