A Look Into The Markets - Nov 21, 2025

"Still don't know what I was waiting for

And my time was running wild, a million dead-end streets and

Every time I thought I'd got it made

It seemed the taste was not so sweet" - Changes by David Bowie.

The minutes from the Fed's latest meeting indicate that policymakers are increasingly cautious about assuming a near-term rate cut. Although the committee has eased once, many officials noted that inflation remains stickier than expected, and that economic activity is solid enough to warrant caution. Some members urged that while they are open to easing in the future, now is not the moment to "front-load" cuts without clearer evidence of inflation moderating.

In practical terms for rates and the housing market: this means another cut in the short term is not a sure bet.

Key takeaways from the Fed minutes

- The Fed is not convinced inflation is cooling fast enough.

Several members emphasized that recent data shows slower-than-hoped progress on inflation, making them hesitant to commit to additional rate cuts without clearer evidence. - Policymakers are divided on the timing of future rate cuts.

Some officials support easing if the economy shows more slowing, while others believe cutting too soon could reignite inflation; creating uncertainty and added volatility for rates. - "Higher for longer" remains on the table if the economy stays resilient.

With growth and labor demand still relatively firm, the Fed signaled it may need to keep policy restrictive longer than markets were expecting, which can keep upward pressure on yields and mortgage rates in the near term.

September Jobs Report: What It Means

The September Jobs Report came in stronger than expected, showing that employers continued to hire at a solid pace. Job gains were broad, unemployment held at historically low levels, and wage growth remained steady. This type of report sends a clear message: the labor market is still healthy, and the economy hasn't cooled as much as the Fed was hoping by this point in the year. Strong hiring is good news for workers and businesses, but in the current inflation-sensitive environment, it can be challenging news for interest rates.

Impact on the Fed and Rates

For the Federal Reserve, this report complicates the path toward future rate cuts. The Fed needs to see convincing evidence that the economy is slowing enough to ease inflation pressures, and a strong employment report does the opposite. Markets tend to interpret these results as the Fed staying cautious or even holding rates higher for longer. As a result, bond yields often move up on strong jobs data, which puts upward pressure on mortgage rates and that did not happen this week.

Bottom line: The September report reinforces the idea that the Fed needs more time and softer data before it can confidently shift toward easing policy. The Fed Funds Futures are currently pricing in just a 30% chance of a Fed Rate Cut in December.

October Existing Home Sales Hit 8-month High

U.S. existing-home sales in October rose to the fastest pace since February, increasing by 1.2% month-over-month to a seasonally-adjusted annual rate of 4.10 million units; slightly above expectations. On a year-over-year basis, sales also improved by about 1.7%, showing a modest uptick in buyer activity. The increase was fueled by lower mortgage rates during late summer, which nudged some buyers back into the market, especially given how long the broader housing segment has been under pressure from high rates and constrained affordability.From a market and economic perspective, this report signals a tentative rebound in housing demand; which is significant because the housing sector often acts as both an economic driver and barometer. A stronger housing market can support consumer spending, jobs in construction and real estate services, and ultimately broader economic growth.

| 30-yr mortgage rates | 20-Nov-25 | |

| 6.26% | ||

| +.02% WoW (6.24%) | -.58% YoY (6.84%) | |

| 10-Year Treasury Note Yields | 21-Nov-25 | |

| 4.09% | ||

| -.02% WoW (4.11%) | -.30% YoY (4.39%) | |

4.00 to 4.20

Last year, the 10-year Note yield spent most of its time above 4.20% and for the past several weeks the 10-year has remained beneath 4.20%. This is a good sign for potentially lower rates ahead. A move convincingly beneath 4.00% a level the 10-year which has not traded beneath for any sustained period in over two years, would be a welcome development for those looking for lower rates.

Looking Ahead

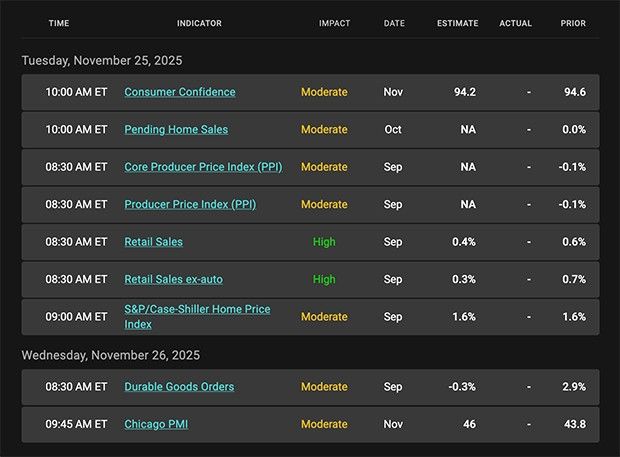

Next week is a short week with the Thanksgiving Holiday. The bond market is closed on Thanksgiving Day and has a shortened session on Black Friday. Speaking of which; that is the day to expect significant holiday shopping, both online and in-store. The real-time data generated from the shopping traffic and sales will be reported and a key driver to move the markets in the weeks ahead.

We do have some Treasury auctions and those have performed well over the past few months. Lastly, there will be some housing data and Fed speak which could move the markets.

|

|

Categories

Recent Posts