A Look Into The Markets - Dec 12, 2025

"Still don't know what I was waiting for..." — Changes, David Bowie.

The Fed Meeting: A Hawkish Rate Cut

At last week's Fed meeting, the Fed delivered a quarter-point rate cut, but the tone surrounding it was anything but dovish. Chair Powell's press conference and the updated forecasts made it clear this was a hawkish rate cut; a move designed to provide modest easing while reminding markets that the Fed is not prepared to declare victory on inflation.

In fact, the new projections leaned more cautiously than many expected. Stronger economic growth, lower inflation, and just one single rate cut penciled in for all of 2026. That combination tells us the Fed believes the economy can withstand tighter policy for longer, and they're in no hurry to open the door to a series of cuts.

Powell reinforced that message by emphasizing that monetary policy is not on a preset path, and that every decision going forward will depend on how inflation and the broader economy evolve. In other words, even though the Fed cut rates, they paired the move with guidance that keeps expectations for future easing restrained. This is the very definition of a hawkish cut; easing on the surface, caution underneath. For housing and mortgage markets, it means that while the Fed may have taken a step toward a more accommodative stance, they are still focused on ensuring inflation continues to move toward their long-run goal before committing to a more aggressive cutting cycle.

A Divided Fed: Higher Growth, Lower Inflation... and Only One Cut in 2026

The meeting also revealed growing dissension inside the Fed. Some members believe inflation is cooling fast enough to justify more cuts soon. Others worry the economy remains too strong, pointing to upgraded forecasts for higher GDP growth, lower unemployment, and inflation that continues drifting toward target.

Despite that optimism, the Fed's longer-run projections were surprisingly conservative: just one rate cut in all of 2026. That's a remarkably slow easing path and shows how cautious (and divided) the committee remains. Policymakers are struggling to balance real economic resilience with the risk of reigniting inflation. This divide explains the uneven messaging coming from Fed speakers over the past several months.

Behind the Scenes: The Fed's Bill-Buying Matters More Than People Think

One under-reported element from the Fed Meeting is the Fed's ongoing plan to purchase short-term Treasury bills to keep the financial system in ample reserves.

Why does this matter?

These bill purchases help stabilize liquidity in the banking system.

More stability generally supports smoother functioning in the long-term Treasury market; the same market that heavily influences mortgage rates.

When liquidity improves, volatility in yields tends to decline, allowing rates to settle into more predictable ranges.

In a market where long-term rates have been moving more on technicals than fundamentals, this is an important and constructive development.

The Bottom Line: A Tough Trend Is Finally Broken

For over one year, the mortgage world has dealt with the confusing, painful phenomenon of lower Fed rates but higher mortgage rates. Buyers couldn't benefit, sellers couldn't price effectively and originators worked overtime explaining the disconnect.

On the heels of the Fed meeting, long-term rates like mortgages declined, which breaks a trend where the previous five rate cuts led to higher mortgage rates.

| 30-yr mortgage rates | 11-Dec-25 | |

| 6.22% | ||

| +.03% WoW (6.19%) | -.38% YoY (6.60%) | |

| 10-Year Treasury Note Yields | 5-Dec-25 | |

| 4.13% | ||

| +.02% WoW (4.11%) | -.09% YoY (4.22%) | |

Looking ahead

The next few weeks will test this new direction. Key inflation releases, Treasury auctions, and continued Fed commentary will determine whether long-term rates can build on this improvement. If inflation keeps easing and the Fed continues leaning toward stability, we could see a healthier alignment between policy cuts and mortgage rates...finally.

Mortgage Market Guide Candlestick Chart

Each candle represents one day of trading. As mortgage bond prices move higher, rates move lower. You can see on the right side of the chart the big green candles, which show higher mortgage bond prices/lower mortgage rates.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, December 12, 2025)

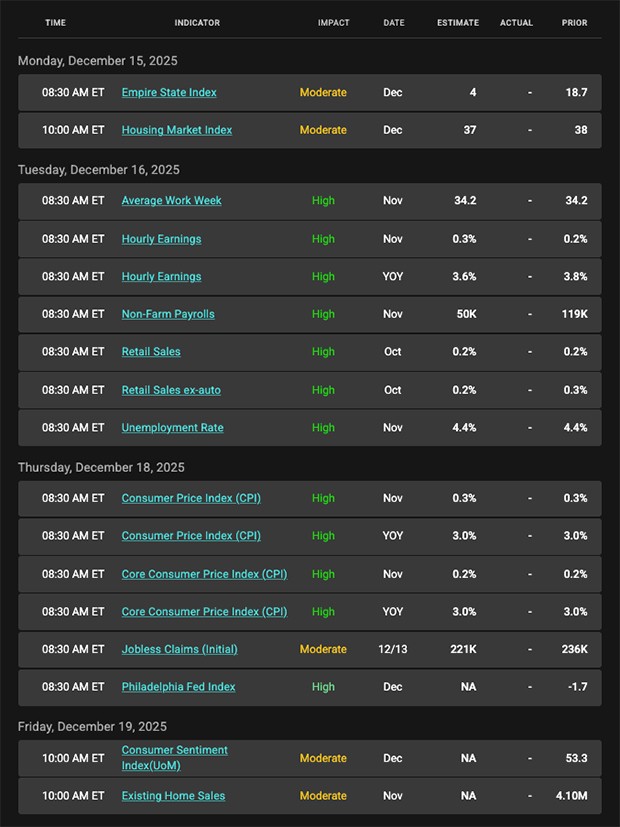

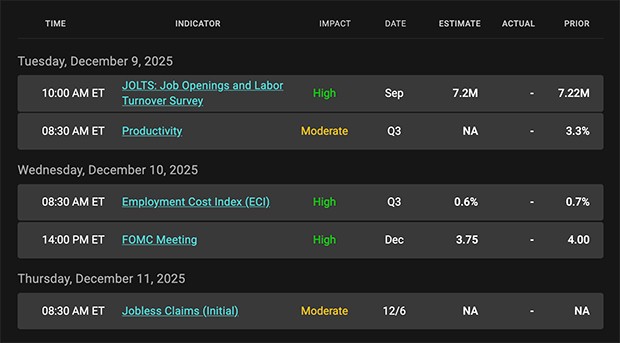

Economic Calendar for the Week of December 15 - 19

|

|

Categories

Recent Posts