A Look Into The Markets - Dec 5, 2025

That changed with a soft ADP employment report on Tuesday, which showed weaker-than-expected private job growth. While ADP isn't always a perfect predictor of Friday's jobs numbers, markets do pay attention, especially during a week with so little else going on. The softer print added to the growing sense that the labor market is cooling, which in turn increased the market odds of a rate cut next week. Those odds of that rate cut currently stand at 90%.

Japanese Rates Rise

Japan made headlines this past week as its central bank signaled the possibility of a rate hike in December, pushing Japan's 10-year government bond yield to its highest level since 2007. That move matters far beyond Japan. The bond market is global, and when yields rise in major economies, investors often shift money across borders in search of better returns. Higher yields abroad can pull capital away from U.S. bonds, which in turn puts upward pressure on our own long-term rates, including mortgage rates. In short, even when the news comes from overseas, it can ripple right through our markets here at home. The good news? Our bonds shook off a brief increase in yield earlier in the week when the Japanese news broke.

| 30-yr mortgage rates | 5-Dec-25 | |

| 6.19% | ||

| -.04% WoW (6.23%) | -.50% YoY (6.69%) | |

| 10-Year Treasury Note Yields | 5-Dec-25 | |

| 4.09% | ||

| .00% WoW (4.09%) | -.09% YoY (4.18%) | |

4.00%

The financial markets are watching 4.00% on the 10-yr Note very closely as it has limited the improvement in rates for the past two years. Should the 10-yr Note yield move beneath 4.00%, mortgage rates will likely head another leg lower as well.

Looking ahead

Next week is shaping up to be one of the most important weeks of the year, with the Fed meeting front and center. But the actual rate cut, which the market widely expects, may not be the big driver for bonds and mortgage rates. What could really move markets is the Fed's updated Summary of Economic Projections (SEP). The SEP is the Fed's quarterly roadmap showing where officials expect growth, inflation, unemployment, and where the Fed Funds Rate will go over the next few years. Markets focus heavily on the "dot plot," which reveals how many cuts Fed members anticipate and how quickly they expect policy to ease. If the new projections show fewer cuts ahead or a slower path lower, rates could bounce. If the dots open the door to more easing, that could support the recent rally in bonds and improvement in rates.

We'll also see a fresh round of Treasury auctions, which will hit the market at a time when yields are sitting near 2025 lows. That makes demand especially important to watch. Strong buying, both at home and from international accounts, would help validate the recent move lower in yields. But if demand is soft, auctions can act as a speed bump and pull rates higher in the short term. With the Fed, the SEP, and supply hitting all at once, next week has all the ingredients to break the quiet trading environment we've been in.

Mortgage Market Guide Candlestick Chart

Each candle represents one day of trading. As mortgage bonds prices move higher, rates move lower. You can see on the right side of the chart, prices moving sideways near the best levels of the year. This means home loan rates continue to hover near the best levels of the year.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, December 5, 2025)

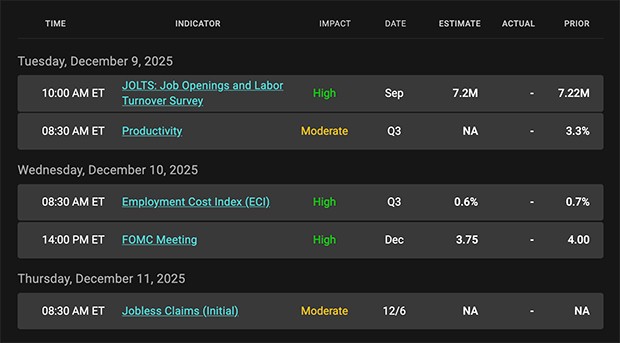

Economic Calendar for the Week of December 8 - 12

|

|

Categories

Recent Posts