A Look Into The Markets - Nov 7, 2025

On the other hand, weaker economic data often has the opposite effect. Signs of slowing growth or cooling inflation suggest the Fed may be able to ease policy sooner, which drives bond prices up and yields down. In other words, markets tend to reward signs of economic slowing with lower rates because they point to less inflation pressure ahead. So, while "good news" sounds positive for the economy, it can be "bad news" for anyone hoping to see lower mortgage rates. And this past week there was some good economic news.

Private Job Gains

The October ADP Employment Report came in stronger than expected, showing that private employers added more jobs than economists had forecast. This labor data points to continued strength in the job market and suggests that businesses are still hiring at a healthy pace despite higher interest rates. It reinforces the view that the economy remains resilient, which could make the Fed cautious about easing policy too soon.

Service Sector Expands

The October Institute for Supply Management (ISM) Services PMI report showed the services sector continuing to expand, with the headline Services PMI coming in at 52.4% and above expectations. The fact that the index remains comfortably above the 50-point mark indicates ongoing growth in service-industry activity, which is important since services account for a substantial portion of the economy.

One of the key sub-components to watch is the Prices Paid Index; essentially how much services firms are paying for inputs and what cost pressures they're facing increased for the 101st consecutive month. Both the good headline number and higher inflation reading was enough to pressure bond prices lower and rates higher. It is also news like that which is emboldening more Fed officials to vote for no rate cut at the December meeting.

The Fed is divided

Adding more uncertainty and volatility to interest rates is the Federal Reserve itself, divided on whether to cut rates at the next meeting in December.

Here are a few current quotes from Federal Reserve officials suggesting they're not ready to commit to a rate cut in December:

- Jerome Powell (Fed Chair): "A further reduction in the policy rate at the December meeting is not a foregone conclusion - far from it."

- Austan Goolsbee (Chicago Fed President): "I'm not decided, going into the December meeting ... my threshold for cutting is a little bit higher than it was at the last two meetings. I am nervous about the inflation side of the ledger."

| 30-yr mortgage rates | 6-Nov-25 | |

| 6.22% | ||

| +.05% WoW (6.17%) | -.57% YoY (6.79%) | |

| 10-year note yield | 7-Nov-25 | |

| Mortgage rates are priced based on the trading activity in mortgage bonds, which we highlight in this chart. | Current: 4.16% ▲ | |

| (Up from 3.97% on Oct 29 after Fed cut) | ||

| You can track what mortgage rates are doing (going up or down) based on what direction the 10-year Note yield is heading. | 1-week change: +0.19% (3.97% → 4.16%) | |

| This time 2024: 4.50% | ||

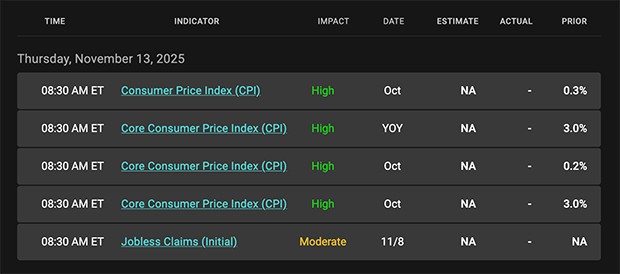

Looking Ahead

Next week, if the government remains closed there will be no economic releases for the market to trade on.The big bond market movers could come by way of Treasury auctions, where the government must sell billions in 10-year Notes and 30-year Bonds. These longer-dated bond auctions are closely watched by the mortgage and housing industry professionals, because if they do poorly and buying appetite is not good, mortgage rates likely rise. The opposite is true.

Fed speakers will also be out offering their thoughts on current conditions and their position on interest rates.

|

|

Categories

Recent Posts