A Look Into The Markets - March 14, 2025

"Where do we go now?" - Sweet Child O' Mine by Guns and Roses.

Stock/Bond Relationship: An Unusual Twist

Conventional wisdom holds that when stocks fall, interest rates drop as investors shift money into bonds, pushing bond prices up and yields down. But this week defied that pattern. Uncertainty over tariffs and fears of slower growth triggered a sharp stock market sell-off and 1,400 points on the Dow in just two trading days. Normally, this would drive rates lower, but bonds hit stubborn technical resistance, halting any improvement. In fact, when stocks staged a modest rebound on Wednesday, interest rates ticked higher...a surprising disconnect.

Inflation Cooling Down

February's Consumer Price Index (CPI) brought good news: inflation came in below expectations, aided by oil prices dropping from $80 in mid-January to the low $70s. Core CPI, a key inflation metric, fell to 3.1% year-over-year, the lowest since last summer. Even better, the monthly .02% reading aligns with an annualized pace of 2 to 2.5%, nearing the Federal Reserve's target.

The Cleveland Inflation Nowcast, a real-time inflation tracker, predicts the Fed's preferred gauge of inflation, The Core PCE, will hit 2.47% by the end of March. If accurate, this would undercut the Fed's forecast that inflation wouldn't dip below 2.5% all year, signaling progress in the fight against rising prices.

Tariff Uncertainty Persists

Tariff speculation continues to roil markets as policies shift. Some tariffs are enacted, others removed, and carve-outs negotiated. The Federal Reserve seems less worried about tariffs themselves and more concerned with the uncertainty they create, alongside signs of an economic slowdown.

Treasury Auctions Struggle

Last week, the Treasury Department auctioned billions in new debt to fund our underfunded government. These auctions underperformed, adding upward pressure on rates and preventing them from retreating to the week's best levels.

| 30-yr Mortgage Rates | 13-Mar-25 | |

| 6.65% | ||

| +.02 WoW (6.63%) | -.09 YoY (6.74%) | |

| 10-year Note Yield | 14-Mar-25 | |

| Below 4.50% | ||

| This time 2024: Below 4.50% | ||

Bottom Line: After nearly two months of steady improvement, interest rates have pulled back from key technical levels. Uncertainty around tariffs, inflation, and growth is clouding the financial markets. Clearer signals, whether from policy or data will dictate the next move.

Looking Ahead

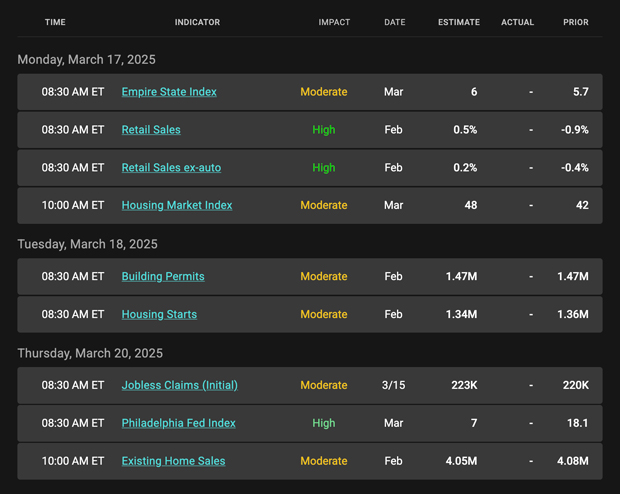

Next week brings important news; The Fed Meeting. No rate cuts are expected, but the Fed's Summary of Economic Projections, released every three months, could steal the spotlight. Updates to forecasts for growth, unemployment, inflation, and rates amid tariff debates, government downsizing, and debt ceiling talks may hint at the direction of rates in the months ahead.

Retail Sales: Here we get the strength of the consumer. With consumer spending comprising nearly two-thirds of economic growth, we want to be sure the consumer continues to spend.

Mortgage Market Guide Candlestick Chart

For homebuyers and refinancers, mortgage rates are the key metric—and they're tied to mortgage bond prices. The chart below shows a one-year view of the Fannie Mae 30-year 5.5% coupon. The rule is simple: rising bond prices mean falling mortgage rates; falling prices mean rising rates. Recent red candlesticks on the right signal trouble—prices have slipped from their highs, nudging rates upward.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, March 14, 2025)

Economic Calendar for the Week of March 17 - 21

|

|

Categories

Recent Posts

concierge@pennergroupproperties.com

16037 SW Upper Boones Ferry Rd Suite 150, Tigard, OR, 97224