A Look Into The Markets - Oct 10, 2025

This move was backed by nearly all committee members, with just one pushing for a bigger half-point slash. As the minutes note, "Almost all participants supported reducing the target range for the federal funds rate by 1/4 percentage point at this meeting." The goal? To gently support jobs without letting prices run too hot, especially as markets are worried more about a softening job market.

On the jobs front, things are easing up without major alarms. The unemployment rate ticked up to 4.3% in August, and job growth has slowed, with big downward revisions showing hundreds of thousands fewer hires than thought. Wages are rising at a tamer 3.5 to 3.7% yearly pace. Yet, the Fed saw no sudden plunge: "Participants generally assessed that recent readings of these indicators did not show a sharp deterioration in labor market conditions." Inflation, meanwhile, nudged higher to 2.7% for overall prices and 2.9% for core (excluding food and energy), partly blamed on new tariffs. It's above the Fed's 2% target but not spiraling, giving policymakers some breathing room.

Looking ahead

The Fed folks stressed a careful, data-driven path, with risks now tilting more toward job worries than price spikes. They updated their statement to highlight "slowed job gains" and "edged-up unemployment," signaling a pivot in focus. "Participants indicated that their outlooks for the labor market were uncertain and viewed downside risks to employment as having increased over the intermeeting period," the minutes explain. Most expect more rate cuts this year to nudge the economy toward balance, but they're wary of overdoing it and reigniting inflation or keeping rates too high and choking growth.In the longer view, the Fed's projections show brighter days: GDP growth picking up in 2026, unemployment stabilizing at low levels, and inflation easing back to 2% by 2027. They're sticking to their dual mission of strong jobs and steady prices. As the minutes affirm, "The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective." Overall, it's a steady-hand approach amid uncertainties like trade policies, keeping the economy on track without big surprises.

| 30-yr mortgage rates | 9-Oct-25 | |

| 6.30% | ||

| -.04% WoW (6.34%) | -.02 YoY (6.32%) | |

| 10-year note yield | 10-Oct-25 | |

| Below 4.50% | ||

| This time 2024: Below 4.50% | ||

Bottom line: Mortgage rates have improved steadily all year and remain within a whisker of the best rates of 2025.

Looking ahead

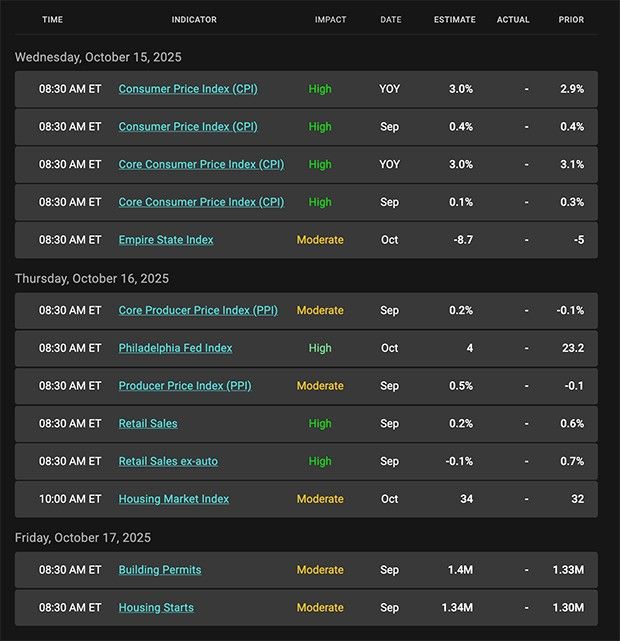

If the government remains shut down, we may see less economic reports for markets to move on. One of the releases scheduled was the Consumer Price Index; a key reading on inflation. There will be Fed speak that will continue until next Friday night when the quiet or blackout period begins.

|

|

Categories

Recent Posts