A Look Into The Markets - Jan 16, 2026

"Don't stop, thinking about tomorrow"—Don't Stop by Fleetwood Mac.

The housing and mortgage markets are sending early but important signals that activity is picking up as we move through the start of the year. MBA weekly mortgage applications surged 29%, a sizable jump that lines up closely with the recent rate improvement.

Additionally, the most recent Pending Home Sales was the highest reading in three years. Together, these two data points act as some of the best leading indicators in housing. They tell us buyers are not just watching from the sidelines, they're getting pre-approved, making offers and preparing to transact. Momentum is clearly building beneath the surface.

Good News for Consumers

On the inflation front, the data continues to cooperate. Core CPI came in at 2.6% year-over-year, below expectations and now approaching the Fed's longer-term target. This matters because Core CPI strips out volatile food and energy prices, giving policymakers a clearer view of underlying inflation trends. Producer Price Index (PPI) data also supported the narrative, showing manageable price pressures at the wholesale level. When producer prices stay contained, it reduces the risk of inflation being passed on to consumers—a constructive backdrop for bonds and interest rates.

At the same time, the economy is showing no signs of rolling over. Retail Sales came in well above expectations, and even after adjusting for inflation, Real Retail Sales posted a strong gain. That's an important anti-recession signal. Consumers are still spending in real terms, which helps explain why the economy has remained resilient even as inflation cools. Growth without inflation is exactly the combination markets want to see.

Interest rates responded accordingly. The 10-year Treasury backed away from the upper end of its recent range, pulling back from the 4.20% level as inflation data improved and bond demand strengthened. That move helped stabilize mortgage pricing and reinforces the idea that long-term rates remain capped unless inflation reaccelerates.

The $200 Billion Purchase

Finally, and something we'll be watching closely going forward—the Administration has called for Fannie Mae and Freddie Mac to purchase up to $200 billion in mortgage-backed securities. This step is aimed squarely at improving liquidity in the mortgage market and narrowing the spread between the 10-year Treasury and 30-year mortgage rates.

That spread has already tightened significantly, down from extreme levels in 2023, and today, 30-year mortgage rates are sitting at three-year lows. Additional MBS demand would further compress spreads and help translate stable Treasury yields into even better mortgage pricing for borrowers.

| 30-year mortgage rates | 14-Jan-26 | |

| 6.14% | ||

| -.02% WoW (6.16%) | -.77% YoY (7.04%) | |

| 10-year Treasury note yields | 14-Jan-26 | |

| 4.14% | ||

| -.04% WoW (4.18%) | -.64% YoY (4.78%) | |

Rate information shared here reflects the national average and is not a guarantee of rates available.

Looking Ahead

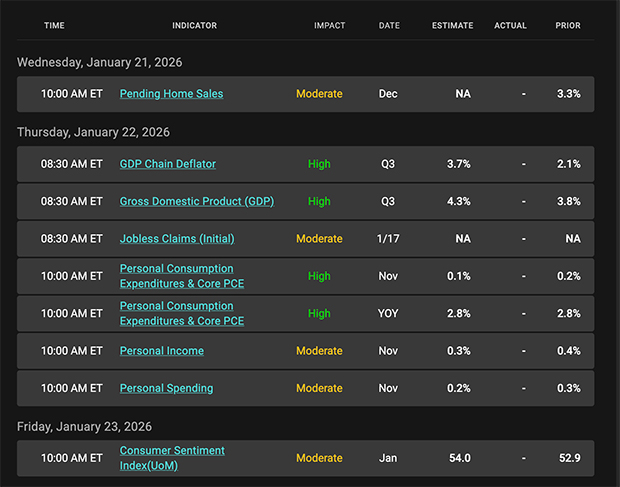

Next week's economic calendar features several big releases that could guide the next leg in interest rates and bond markets, starting with the Fed's preferred inflation gauge, Core PCE. Core PCE measures consumer prices excluding food and energy and is the inflation metric the Fed pays closest attention to. The most recent data shows core inflation running around 2.8% year-over-year, still above the Fed's 2% target but on a downward path. Markets will be watching closely to see if this next reading confirms continued cooling. Getting closer to or through that 2% target could reinforce expectations for rate cuts later in the year.

We'll also get the third and final reading of third-quarter GDP, which currently stands at an annualized pace of about 4.3%, reflecting relatively robust consumer spending, exports and government outlays. Although this figure is backward-looking, it gives markets another data point on the economy's strength and growth trajectory before year-end and helps calibrate expectations for monetary policy.

Finally, the Fed enters a period known as the "blackout" or quiet period ahead of the next FOMC meeting. During this time, Fed officials do not speak publicly about monetary policy, which reduces new forward guidance and places even more importance on data releases. With no Fed voices out next week, markets will be leaning heavily on the incoming economic reports, especially Core PCE and GDP, to judge whether inflation and growth are evolving in a way that supports or delays future rate cuts.

Mortgage Market Guide Candlestick Chart

Each candle represents one day of trading. As mortgage bonds prices move higher, rates move lower. You can see on the right side of the chart how Mortgage Bond prices are trading at three-year highs, which means three-year rate lows.

Economic Calendar for the Week of January 19–23

|

|

Categories

Recent Posts