A Look Into The Markets - June 27, 2025

"Don't stop believin' Hold on to that feelin"

- Don't Stop Believin' by Journey.

In a week packed with headlines, the reported ceasefire between Israel and Iran stood out. While the future remains uncertain, markets reacted positively, signaling potential stability. Oil prices, which spiked above $80 per barrel in just 24 hours, plummeted to the mid-$60s; a historic drop. The bond market, favoring lower oil prices, embraced this decline, boosting both stocks and bonds.

Fed Chair Powell Faces Pressure to Cut Rates

President Trump and his cabinet have long criticized the Federal Reserve's stance on interest rates, urging cuts amid low inflation and energy prices. Following the June 18th Fed meeting, dissent is growing among Fed members. Some now advocate for a rate cut at the July 30th meeting.

- Federal Reserve Vice Chair of Supervision, Michelle Bowman, expressed reduced concern about tariffs driving inflation and is open to a July rate cut if inflation remains contained.

- Fed Governor Christopher Waller noted that tariffs are unlikely to significantly boost inflation, supporting a potential rate cut next month.

- Chicago Fed President Austan Goolsbee remarked, "Somewhat surprisingly, the impact of tariffs has not been what people feared."

First Quarter GDP Finalized

The third and final reading of Q1 GDP came in at -0.5%, viewed as an outlier due to a massive trade deficit tied to anticipated tariffs. A recession requires two consecutive quarters of negative growth, but Q2 is projected to grow by nearly 3.00%. Most economists do not foresee a recession in 2025 or 2026.| 30-yr Mortgage Rates | 26-Jun-25 | |

| 6.77% | ||

| -.06 WoW (6.81%) | -.09 YoY (6.86%) | |

| 10-year Note Yield | 27-Jun-25 | |

| Below 4.50% | ||

| This time 2024: Below 4.50% | ||

Looking Ahead

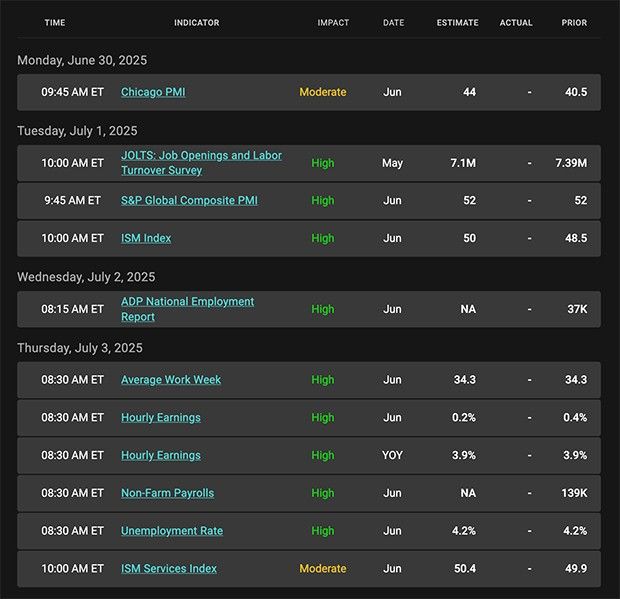

Next week is shortened by the July 4th holiday. It's also Jobs Week, with labor market data in focus. Weak readings could strengthen calls for a July rate cut, amplifying dissenting Fed voices concerned about a slowing labor market.

|

|

Categories

Recent Posts