A Look Into The Markets - May 23, 2025

Originally called Decoration Day, Memorial Day was first observed after the Civil War and is in remembrance of those men and women who have died in military service for our country. Memorial Day was declared a Federal Holiday in 1971 and commemorated on the last Monday in May. Memorial Day weekend is often the unofficial kick-off of summer with weekend travel trips, backyard barbecues, time on the water, and enjoying the company of family and friends.

“May freedom forever fly, let it ring. Salute the ones who died” - Chicken Fried by Zac Brown Band.

Bonds Hate More Bonds

On Friday, May 16, Moody's Ratings downgraded U.S. debt by one notch. Now, all three major rating agencies have removed the U.S.'s AAA rating status. When the bond market reacted to the news on Monday, it responded poorly, with rates moving higher.

The ratings firm cited rising debt and deficit levels, along with political dysfunction, primarily centered around debt ceiling debates. This echoes what S&P said about U.S. debt when they first downgraded it in August 2011.

20-Year Bond Auction Goes Poorly

When governments run budget deficits, they must sell bonds to fund operations. The U.S. relies on a wide range of buyers, both domestic and foreign, to purchase these bonds. If demand at these auctions is weak, the U.S. must offer higher interest rates to sell all the bonds. When this happens, Treasury rates rise, which also puts upward pressure on mortgage rates.

On Wednesday, the U.S. Treasury sold $16 billion in 20-year bonds, but the results were lackluster. Soft buying demand meant higher interest rates were needed to sell the debt. This pushed the 10-year note yield to 4.60%, a level last seen in January. It also drove mortgage bond prices and rates to their highest levels since January.

Proposed Tax Bill

A new tax bill proposed by the Trump administration includes a permanent extension of the tax cuts enacted in 2017, along with additional tax breaks. There's speculation that the uptick in interest rates this past week is partly attributable to this bill, as it would increase already large government deficits. If this bill passes both the House and Senate, we'll be watching how the bond market reacts.| 30-yr Mortgage Rates | 22-May-25 | |

| 6.86% | ||

| -.04 WoW (6.90%) | -.08 YoY (6.94%) | |

| 10-year Note Yield | 23-May-25 | |

| Above 4.50% | ||

| This time 2024: Below 4.50% | ||

Bottom Line: Uncertainty remains high, bringing increased volatility. This is why we're seeing interest rates fluctuate with news related to tariffs and fiscal policy. This trend will likely continue until we see more clarity.

Looking Ahead

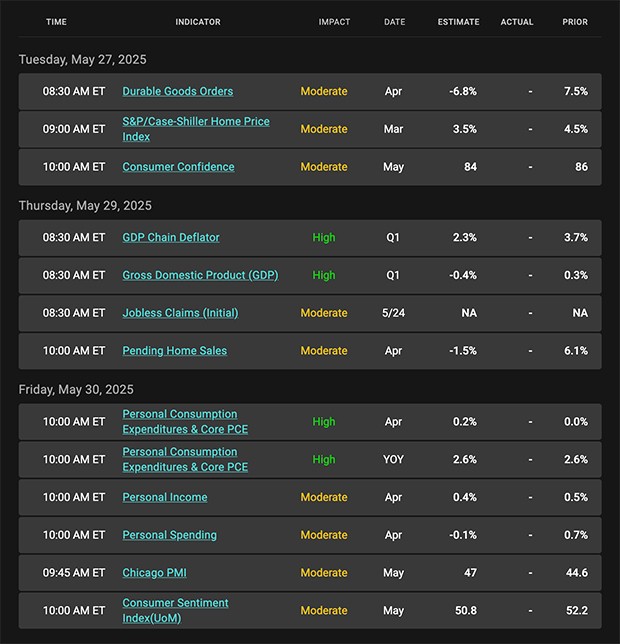

Next week is shortened due to Memorial Day. In this short week, there will be plenty of market moving news including Core PCE, the Fed's favored gauge of inflation and the Minutes from the previous Fed Meeting. Additionally, there will be more Treasury supply auctioned off which will be watched for buying appetite.

|

|

Categories

Recent Posts